Price increases throughout the U.S. economy over the past few years have made nearly everything more expensive, but perhaps no spending category has squeezed Americans’ budgets like the cost of housing. Between high costs to buy a home and skyrocketing rents, non-homeowners are faced with impossible choices throughout the market.

Throughout 2020 and 2021, low interest rates and rising household savings and incomes positioned many Americans to buy real estate. But high competition and low supply created a boom in the residential real estate market that sent home prices in the U.S. to record highs. With home prices elevated and interest rates rising to cool the market, more would-be buyers have been priced out, increasing the competitiveness of the rental market and in turn driving rents upward.

These shifting conditions have made things difficult for households debating whether to buy or rent. Shelter is already the largest spending category for most U.S. households, but larger economic trends have raised the financial stakes on the buy-or-rent decision. For now, at least, renting has taken the edge.

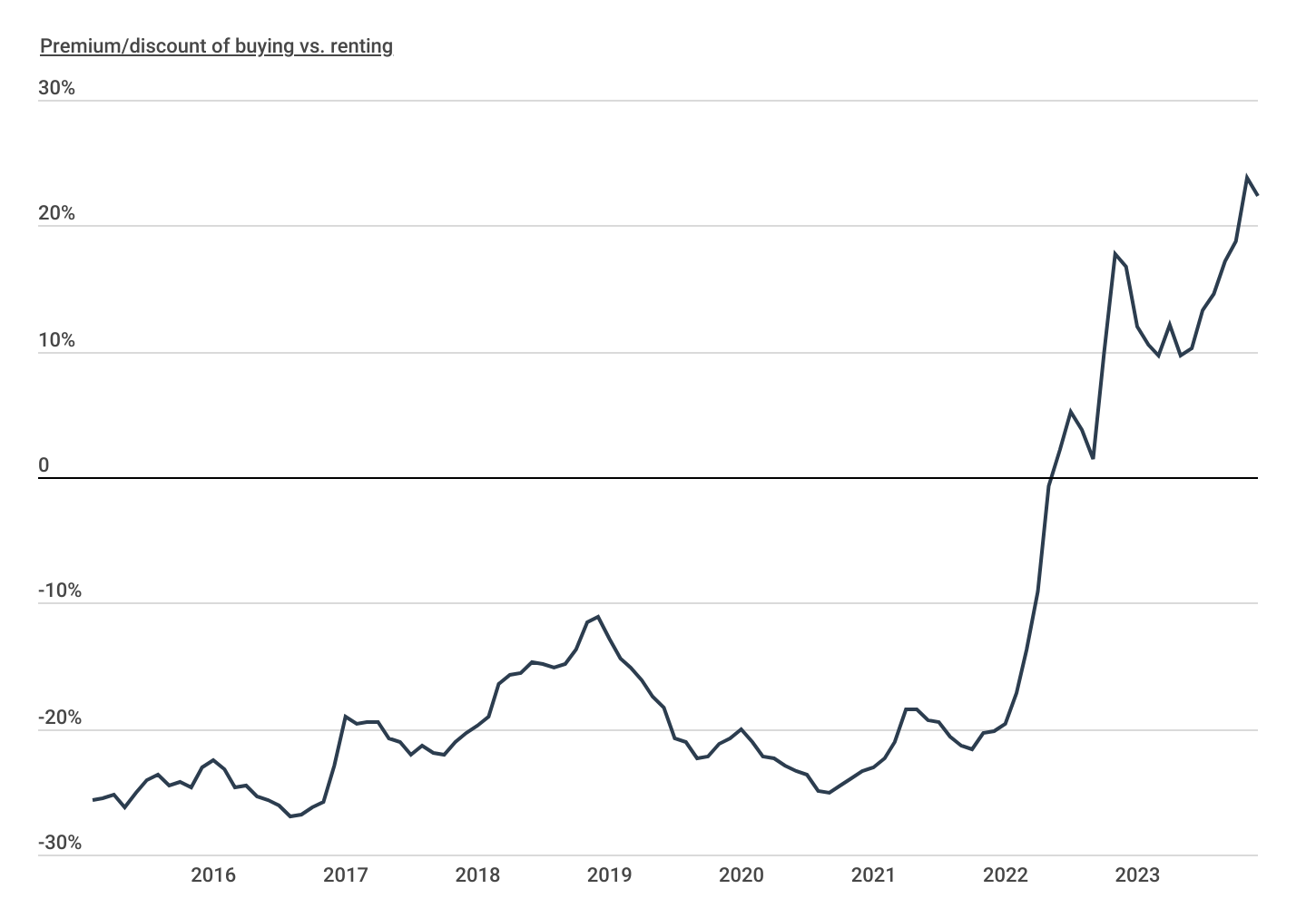

The Cost of Buying vs. Renting Over Time

Amid elevated interest rates and home prices, the buying premium has skyrocketed

Source: Construction Coverage analysis of Zillow, U.S. Census Bureau, and Freddie Mac data | Image Credit: Construction Coverage

In recent years, the typical monthly costs of buying a home after accounting for sales prices, mortgage rates, and property taxes had fallen well below the costs of typical rents in the U.S. Relatively low home costs following the Great Recession and a period of low interest rates kept mortgage payments affordable for much of the 2010s. Even as home prices began to increase amid the competitive market in 2020 and 2021, low interest rates still made buying more affordable.

But beginning in 2022, the combination of high home prices and high interest rates tilted the scales in favor of renting. Mortgage interest rates have more than doubled since January 2022, and while the pace of home price increases has slowed, the median home price is still up nearly 11% over the same span. As of November 2023, the typical monthly payment for a home in the U.S. is now more than 22% higher than the typical monthly rent.

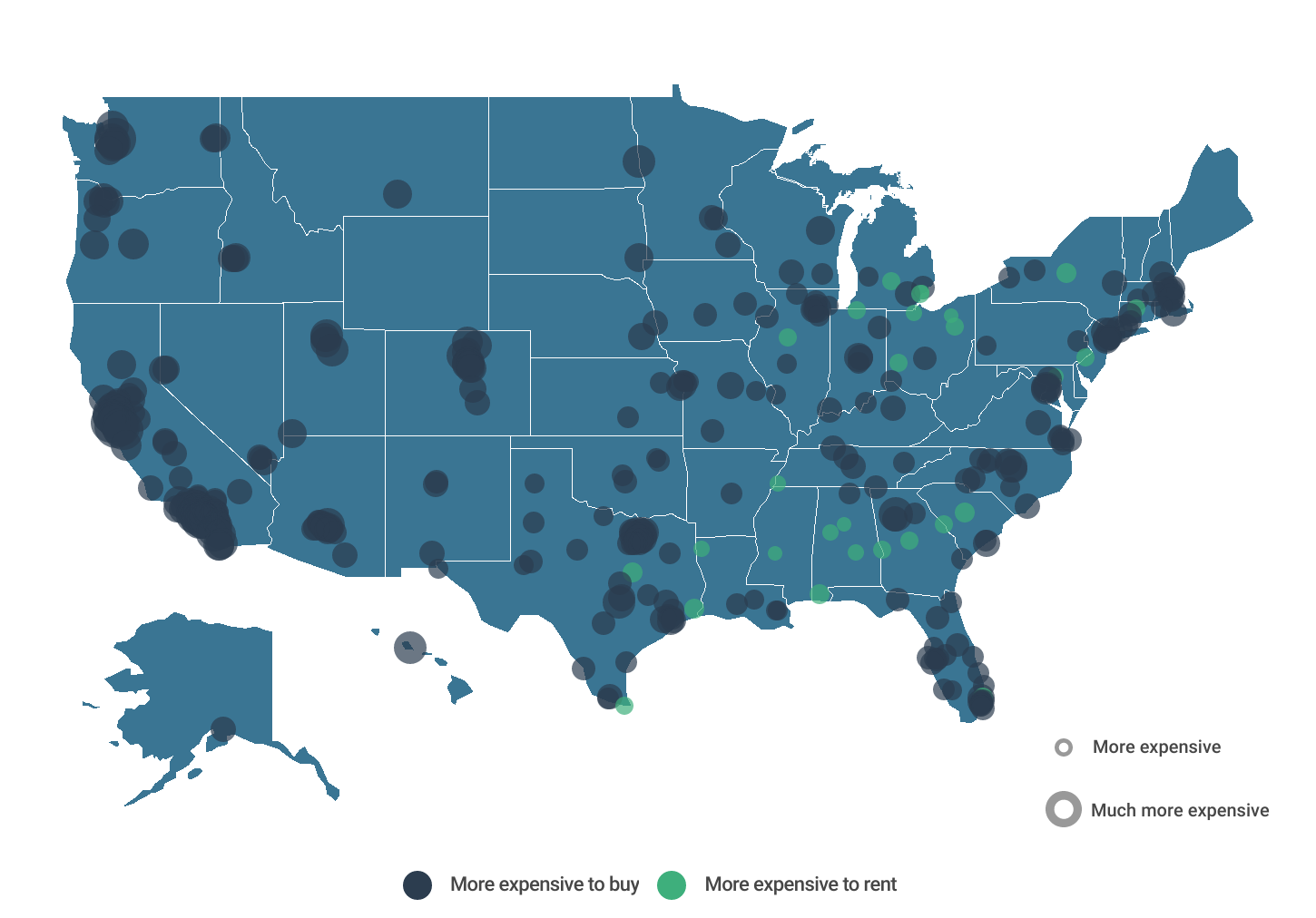

The Cost of Buying vs. Renting by City

Residents in California & Washington will pay the largest premium to buy

Source: Construction Coverage analysis of Zillow, U.S. Census Bureau, and Freddie Mac data | Image Credit: Construction Coverage

And within some geographic markets, buying is unquestionably more difficult. Locations that face low supply, competitive markets, and high home prices—like cities throughout California and in the greater Seattle, WA region—can be two or even three times more expensive for buyers. Fast-growing cities like Frisco, TX and Scottsdale, AZ are also proving especially challenging for buyers.

Out of the 338 U.S. cities considered in this analysis, only 28 are currently more affordable for buyers than renters. Most of these locations are found in Southern states like Alabama, Mississippi, Arkansas, and Louisiana or in Rust Belt locations like Ohio and Michigan. In these locations, home costs remain relatively low, allowing buyers to save relative to the cost of renting.

Below is a complete breakdown of more than 300 U.S. cities. The analysis was conducted by Construction Coverage, a website that compares construction software and insurance, using data from Zillow, the U.S. Census Bureau, and Freddie Mac. For more information, refer to the methodology section.

The Cheapest Large Cities for Homebuyers

The Cheapest Midsize Cities for Homebuyers

The Cheapest Small Cities for Homebuyers

Methodology

Photo Credit: Imagenet / Shutterstock

The data used in this study is from Zillow’s Home Value Index (ZHVI) and Observed Rent Index (ZORI), U.S. Census Bureau’s 2022 American Community Survey, and Freddie Mac’s Primary Mortgage Market Survey. To determine the relative cost of buying vs. renting by location, researchers calculated the percentage difference in the monthly mortgage payment and property taxes for a median price home compared to the monthly rent payment for a median price rental. The monthly mortgage payment reflects a 30-year mortgage with a 10% down payment at a 7.44% interest rate. Monthly property tax estimates were obtained using American Community Survey data by dividing aggregate annual property taxes paid in each location by the aggregate value of all homes. The resulting percentage was multiplied by the median home price and divided by 12. Only locations with available data from all sources were included in the analysis. To improve relevance, cities were divided into groups based on population size: large (350,000+), midsize (150,000–349,999), and small (100,000–149,999).

For complete results, see Cities Where It’s Cheaper to Buy Than Rent on Construction Coverage.